Dr Kwabena Duffour, a shareholder of the defunct uniBank Ghana Limited,has moved to court to begin a fight to reclaim uniBank.

Dr Kwabena Duffour’s lawyer, Professor Raymond A. Atuguba of Atuguba and Associates filed a suit against the Bank of Ghana over the revocation of the license of uniBank.

Dr Duffour, who is a former Governor of the Bank of Ghana wants the High Court in Accra to order the Bank of Ghana to give him back his bank.

In the suit filed on Monday, August 20, 2018, Dr Duffour is asking for an order of injunction restraining the Bank of Ghana from expropriating uniBank by its purported vesting of “good assets and liabilities” in Consolidated Bank Ghana Limited.

The Bank of Ghana in August 2018 announced the consolidation of five local banks into a new state-owned bank called the Consolidated Bank Ghana Limited.

The 5 banks are UniBank, Beige Bank, The Construction bank, The Royal Bank, and Sovereign Bank.

Among the challenges uniBank faced for which the BoG added it to the consolidated entity was that it had capital deficit of GHs 7.4 billion.

Over 89% of its loans were also non-performing, while it had its loans and advances overstated by GHs 1.3 billion.

Other reliefs are that he wants a declaration that the license purportedly granted to the Consolidated Bank Ghana Limited was not granted in accordance with Act 930 and therefore is “null and void.”

He is also seeking a declaration that the “good assets and liabilities of uniBank, including deposits of depositors, cannot be lawfully vested in Consolidated Bank Ghana Limited.

He is also asking for an order of mandatory injunction requiring the Bank of Ghana to restore uniBank to private management and shareholding and any other reliefs which the court deems fit or considers just.

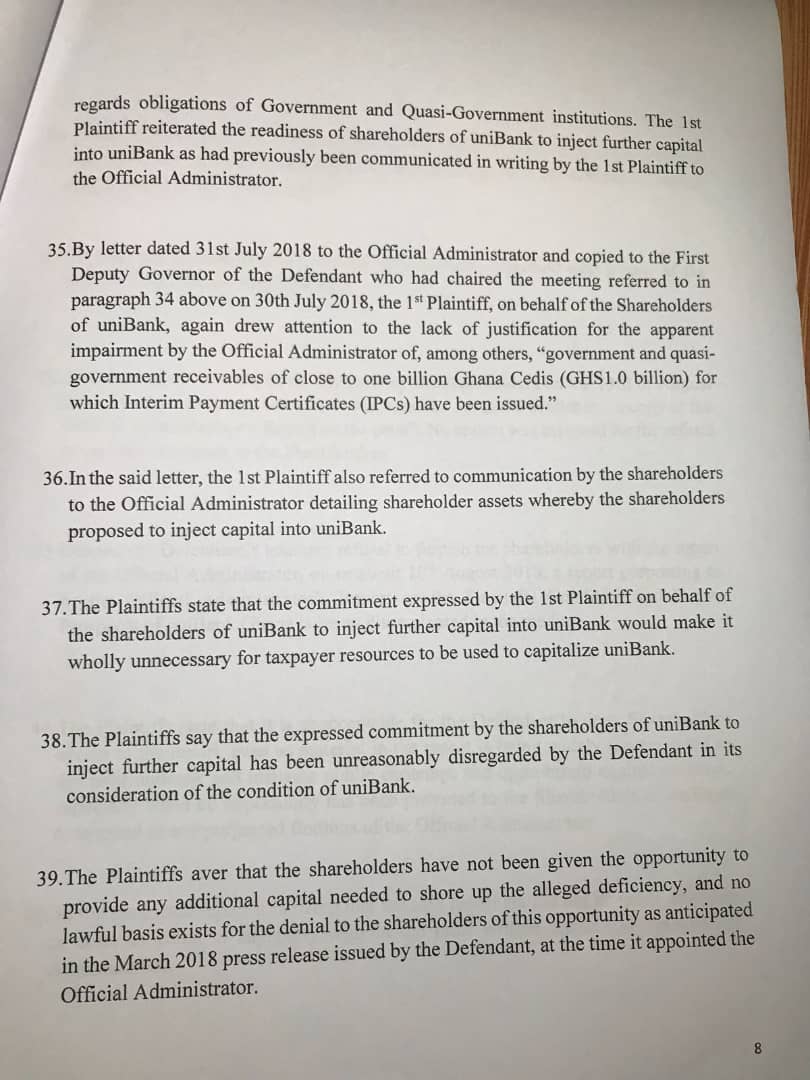

Lawyers for Dr Duffuor argues in the suit that, the BoG acted “unreasonable” and in bad faith in revoking the license of uniBank.

Comments are closed.